Creating a diversified investment portfolio is one of the most effective ways to manage risk while still aiming for solid returns. By spreading investments across various asset classes, sectors, and geographical regions, investors can reduce the potential impact of a poor-performing asset on their overall portfolio. Michael Shvartsman, an expert in investments, explains, “Diversification is not about eliminating risk, but about managing it. By spreading investments across different asset types, you reduce the likelihood that a single negative event will significantly harm your portfolio.”

What Is Diversification?

Diversification involves investing in a mix of assets to balance risk and reward. The idea is that different types of investments perform differently under various economic conditions. By including a wide range of assets, an investor is less vulnerable to losses from a single market downturn.

Key Elements of a Diversified Portfolio

- Asset Classes

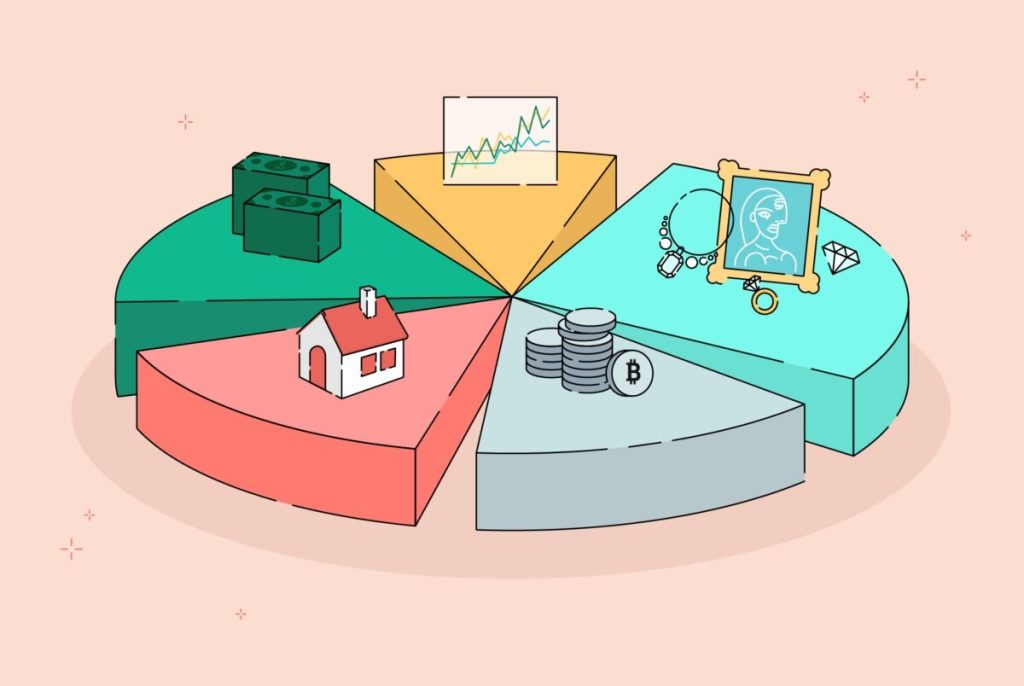

The first step in building a diversified portfolio is selecting different asset classes. A well-balanced portfolio typically includes a mix of:

- Stocks: Equities offer the potential for growth but can be volatile.

- Bonds: These are generally more stable and provide regular income, making them a good counterbalance to stocks.

- Real Estate: Property investments can offer both income through rents and growth through property value appreciation.

- Commodities: Assets like gold, oil, and agricultural products can act as a hedge against inflation and market fluctuations.

Michael Shvartsman emphasizes the importance of balancing these asset types: “Each asset class behaves differently under various market conditions. A portfolio balanced with stocks, bonds, real estate, and commodities can help ensure that when one area underperforms, others may provide stability.”

- Geographical Diversification

Investing across different countries and regions further enhances diversification. By including international assets, investors can reduce their exposure to risk specific to one country’s economy or political climate.

Michael Shvartsman advises that international investments are a key component: “Geopolitical and economic events can have significant impacts on markets. By diversifying internationally, investors can protect themselves against the negative effects of events confined to one region.”

- Sector Diversification

Within asset classes, it’s also important to diversify across different industries. For example, an investor who focuses only on technology stocks may face heavy losses if the tech sector suffers a downturn. By spreading investments across industries like healthcare, consumer goods, and energy, the portfolio becomes more resilient.

Michael Shvartsman points out, “No sector is immune to downturns. Investors should aim to have exposure to a variety of industries to maintain balance and stability.”

Benefits of a Diversified Portfolio

- Reduced Risk

Diversification lowers the overall risk of a portfolio. By holding a wide range of investments, you are less likely to experience significant losses due to the poor performance of a single asset or sector. The risk of one area of the market collapsing is mitigated by the stability or gains in other areas.

Michael Shvartsman states, “Risk reduction is one of the key benefits of diversification. A well-diversified portfolio is like having multiple safety nets, ensuring that the portfolio remains stable even during market volatility.”

- Potential for Steady Returns

While diversification may limit large gains from any single asset, it can also reduce the chances of experiencing substantial losses. This balance can lead to steadier, more consistent returns over the long term.

Michael Shvartsman adds, “Diversification is about finding the balance between risk and reward. You may not experience huge gains from any single investment, but your overall portfolio should perform more consistently.”

- Protection Against Market Volatility

Markets can be unpredictable, and economic events can lead to sudden changes in asset values. A diversified portfolio helps protect against these swings by including a mix of assets that perform differently during various market cycles.

“Volatility is part of investing,” says Michael Shvartsman. “By diversifying, you give yourself a buffer. When one asset class or region experiences volatility, others may offer stability, reducing the impact on your portfolio.”